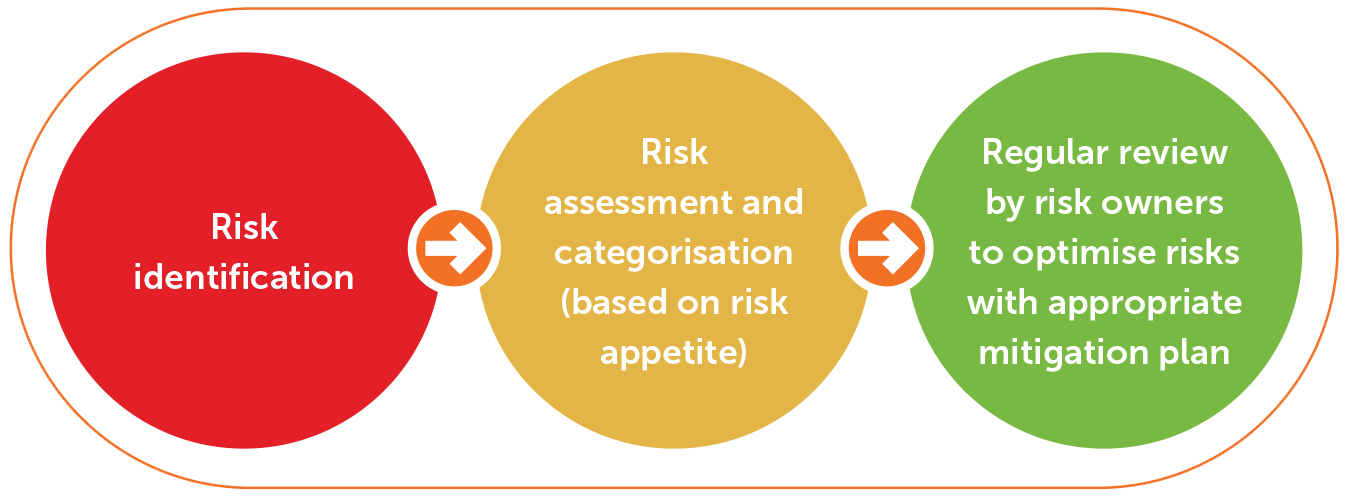

In line with our Enterprise Risk Management (ERM) policy and integrated assurance methodologies, we have established processes and practices across our organisation that enable us to proactively identify, analyse and mitigate risks that might impact our operations. We believe risks are multi-dimensional and, therefore, need to be addressed in a holistic manner, considering the changes in the external environment and robustness of our internal processes.

At IndianOil, the ERM framework is spearheaded by the Risk Management Committee (RMC), a Committee comprising of Board members, who actively ensure that risk management activities are undertaken as per established policies. Further, the Risk Owners of all divisions/ departments are responsible for identifying and assessing the risks in their respective areas/units, before reporting them to the Risk Management Compliance Board (RMCB), which comprises senior executives across divisions and is headed by Chief Risk Officer. The report is then evaluated by the RMCB, who provide enterprise-wide view of the risks to RMC, Audit committee and to the Board.

| Risk Assessment | Mitigation Plan | Material issues Addressed & Capital Impacted |

|---|---|---|

Supply & Distribution:During the ongoing pandemic, it is vital that our business continues to operate by providing uninterrupted services to our customers. But the volatile and uncertain economic conditions coupled with lockdown restrictions threw up unprecedented challenges. Our continuous success depends on our ability to supply goods as and where required. |

Even during challenging times, when the outbreak of the Covid-19 pandemic caused severe disruptions to the supply chain across the globe, we, at IndianOil, continued to meet our operational goals. Our dedicated team of employees and channel partners ensured that there is no disruption in supply of energy - be it fuel at our Retail Outlets, LPG at home of our consumers or supply of fuel to various Industries. In fact, during the year we launched differentiated products like XP100 and XtraTej. The situation was closely monitored by the top management and necessary actions were taken from time to time. |

Supply & Distribution:

Capital impacted:

|

Alternative Energy & Environment Conservation:Carbon emission is one of the key environmental challenges for us at IndianOil. We make continuous effort towards reducing energy consumption, improving efficiency, and reducing carbon emissions to provide sustainable and low carbon products to our customers. Our new projects and business development initiatives are strategically directed towards areas of BioGas and Electric Vehicles sectors. Going forward, our inability to execute these green-projects and curtail emissions might have an adverse impact on our financial position as it may result in loss of market share/business opportunity, attract penalties and fines that impact our brand reputation. |

Our deep understanding of environmental challenges helps us to not only reduce our emission levels, but also generate new business opportunities for greener products and renewable energy options. Further, we are increasing consumption of clean and alternative energy, such as natural gas and renewables. We are also constantly working towards identifying areas where we can ensure energy efficiency and reduce carbon emissions. Specific investments have been directed towards projects focused around electric mobility. Our joint venture in natural gas further strengthens our resolve to expand our business that reduce carbon emissions. |

Supply & Distribution:

Capital impacted:

|

Margin & Profitability:We operate in a highly dynamic industry and our downstream oil business is exposed to fluctuations in crude oil prices, crack spreads supply risks, geo-political uncertainties, and an array of market variables, such as seasonality of demand, pricing and taxation. Given the scale of our operations in domestic and international markets, we are exposed to various risks arising from fluctuations in foreign exchange rate, interest rate, etc. which have an adverse impact on our financial position and impact our margins. Fuel & loss, energy consumption, etc. also have significant impact on our margin & profitability. |

Our finance team continuously monitors the macro and micro-economic environment that can potentially have an impact on our business. Proactive measures and predefined control measures including hedging across multiple financial operations ensure mitigation of risk arising out of fluctuation in prices of product, foreign exchange, interest, etc. Our operation team takes all necessary steps to decrease Fuel & loss, energy consumption and monitor all other expenditure to improve margin & profitability. |

Material topics addressed:

Capital impacted:

|

Cyber Security:Maintaining the security of internal database and customer information is of utmost importance for IndianOil. Being one of India’s largest data networks, any information breach, unauthorised access and/or loss of sensitive or confidential information could have a long and significant impact on business operations and/or brand reputation. |

At IndianOil, we remain committed to protect sensitive data, not just of our internal processes and customers, but of all our partners and employees alike. We have implemented a defence-in-depth cyber security architecture. We are one of the few organisations to have a strong and robust Data Privacy Policy. Further, all our data centres are ISO 27001:2013 certified. |

Material topics addressed:

Capital impacted:

|

Health, Safety & Well-being:Safety practices and initiatives should evolve with the macro-economic scenario. Our inability to meet employee expectations and their safety and well-being might have an adverse impact on the Company’s brand value, financial position and operations. |

At IndianOil, the health, safety and well-being of our employees and contractual workers have always been a key priority. Since the outbreak of the Covid-19 pandemic, we strengthened our safety practices further to fight the virus together and serve our country. Along with ensuring their physical safety and well-being, we also emphasised on the emotional and mental health of our people. To minimise threats to human health and safety, we also issued and implemented policies and practices, undertook awareness drives, provided protective gears and conducted regular health check-ups. Spread of Covid-19 was closely monitored and various administrative controls were undertaken, including the implementation of thermal screening at entry points, practice of proper hygiene/ sanitation measures, physical distancing, staggered office timings, allowing work from home to identified employees, etc. Employees and their family were also encouraged to vaccinate themselves at the earliest. |

Material topics addressed:

Capital impacted:

|

Project Execution:Delay in land acquisitions, obtaining approvals from regulatory bodies, failure to avail necessary clearances and lack of infrastructure support may result in significant cost escalation of projects, coupled with delay in execution/completion within the original time frame. |

An experienced and dedicated team at IndianOil continuously monitors all the critical activities of projects under execution across the country. Regular meetings and timely intervention at all stages of projects ensure enhanced control over each activity, avoiding any time and cost overruns. With a strong governance and due diligence framework in place, all projects are partnered with reputed vendors, ensuring continued business activity. |

Material topics addressed:

Capital impacted:

|