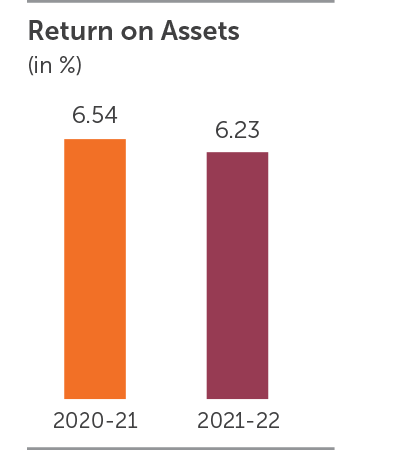

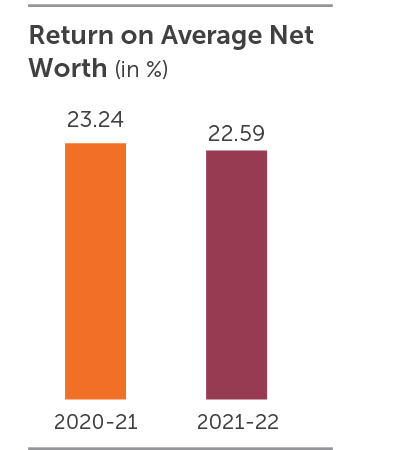

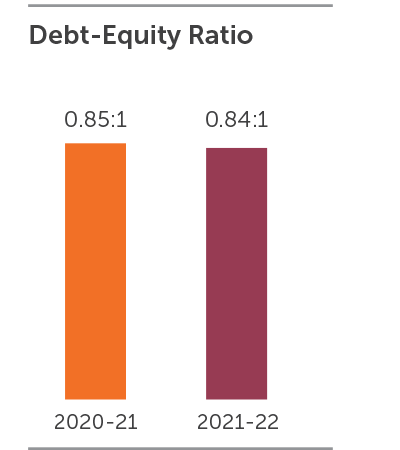

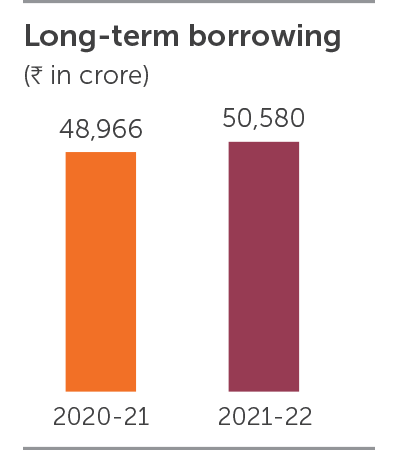

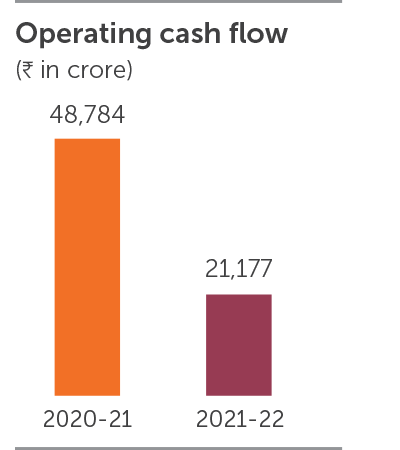

During the year, we continued to maintain an optimum debt to equity ratio of 0.84:1. We continue to adopt lean financial measures across operations to maintain liquidity with minimum stress on the balance sheet.

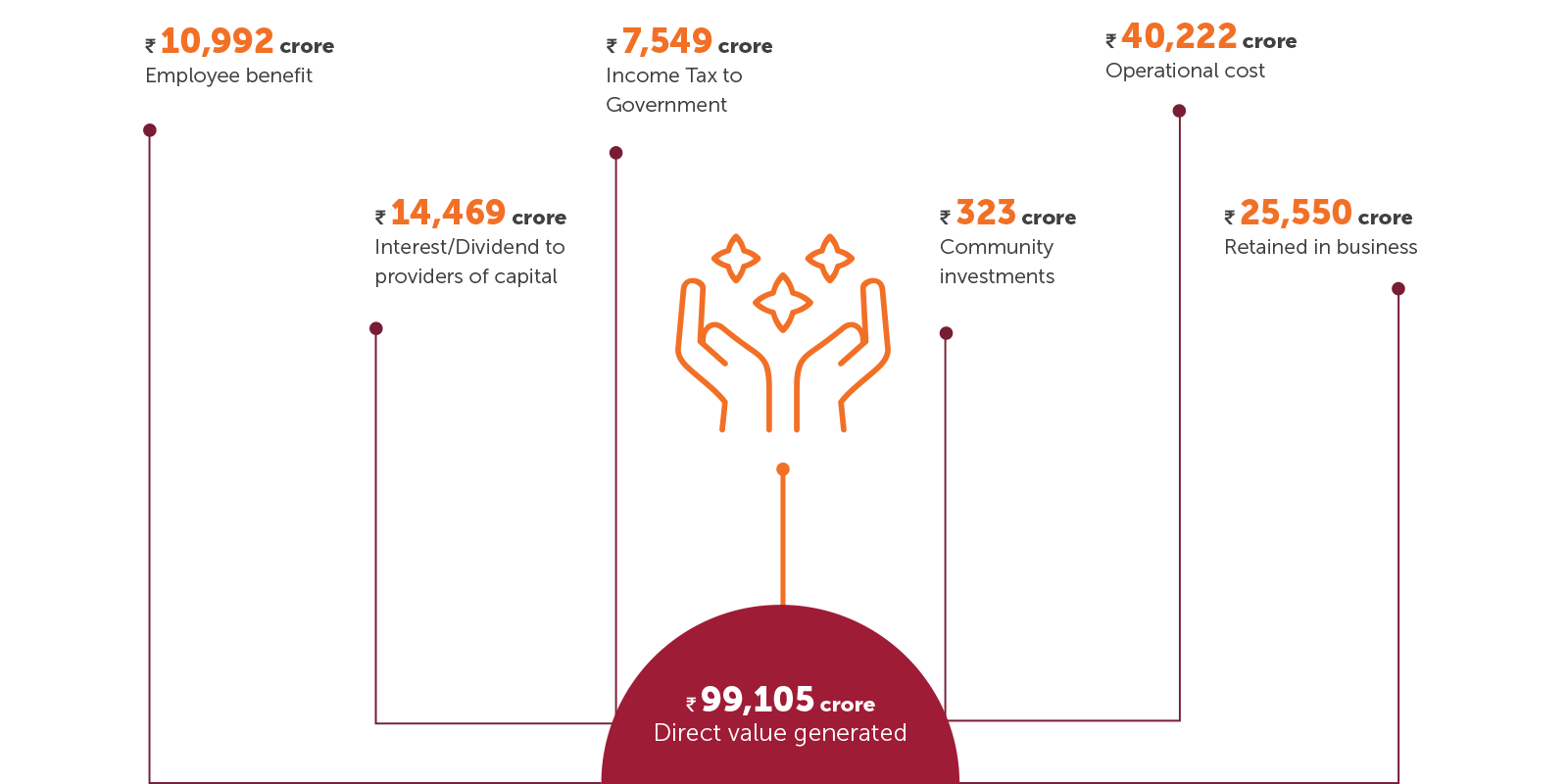

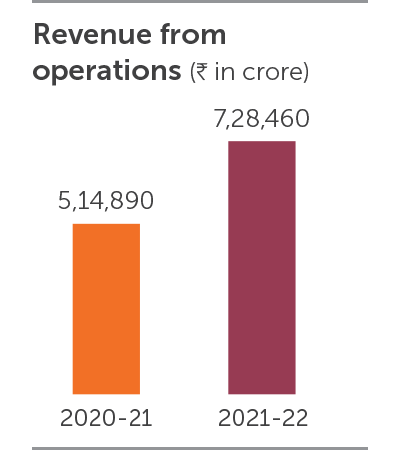

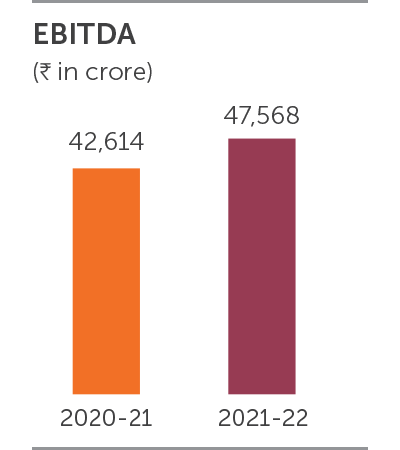

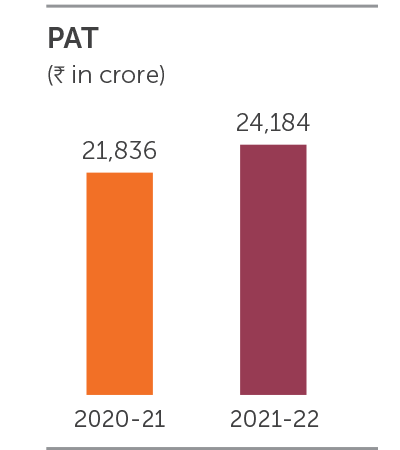

With the revival of demand, we geared our operations to address the rising energy needs of India. During the year, we reported highest ever revenue and net profit which stood at ₹ 7,28,460 crore and ₹ 24,184 crore respectively.

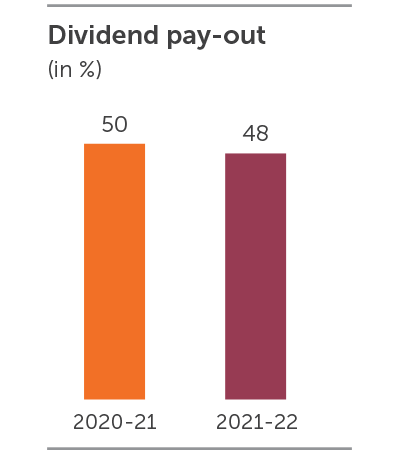

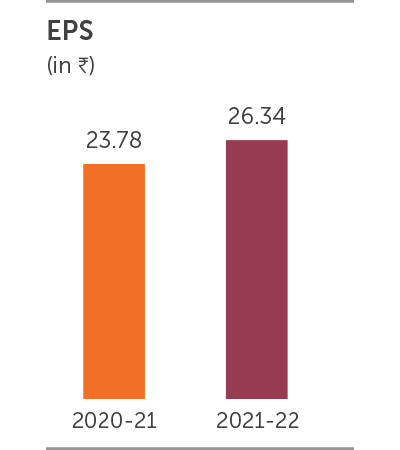

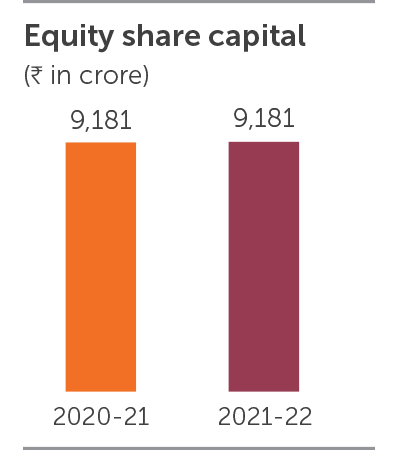

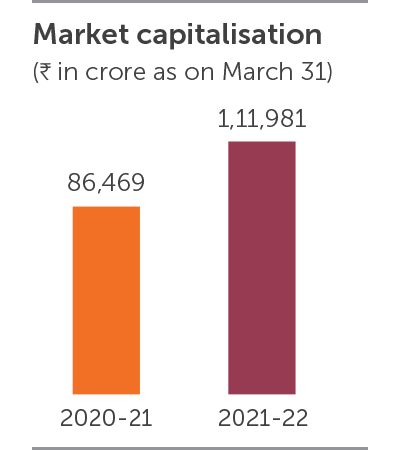

Our consistent growth in revenue and profitability has enabled us to create superior and consistent value for our shareholders year-afteryear. During 2021-22, the EPS registered a growth of 11% from ₹ 23.78 per share in previous year to ₹ 26.34 per share. We declared a total dividend of ₹ 11,568 crore (including interim dividend of ₹ 8,263 crore) for the year. We also issued bonus equity shares in the ratio of one equity share of ₹ 10 each for every two equity shares of ₹ 10 each held.