Material Issues

Optimal Capital Allocation

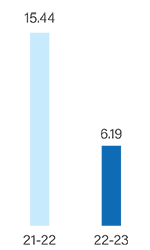

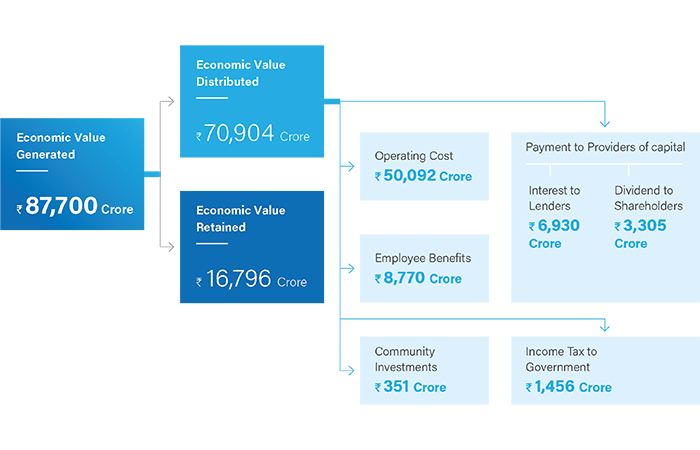

At IndianOil, our prudent financial policies are designed to promote efficient utilisation of assets and funds. We prioritise optimal capital allocation to drive strategic investments and maximise profits. This approach ensures effective utilisation of working capital, strengthens our research and development capabilities, fosters infrastructure development, and delivers attractive returns to our shareholders.

₹ 37,287 Crore

Capital expenditure

Strategic investments

With disciplined treasury management, we have made strategic investments in projects with shorter payback periods. It has not only helped us to expand operations and complete acquisitions but has also generated value, enhanced efficiencies, and enabled us to implement cost-effective measures. Each capital expenditure plan undergoes meticulous evaluation to help us maintain acceptable leverage ratios.

₹ 818 Crore

Invested in joint ventures and subsidiaries