-

Corporate Overview

- Harnessing Infinite Energy,

Powering a Sustainable

Tomorrow - IndianOil - Etching India’s

Growth Story - Performance with Purpose

- Chairman’s Message

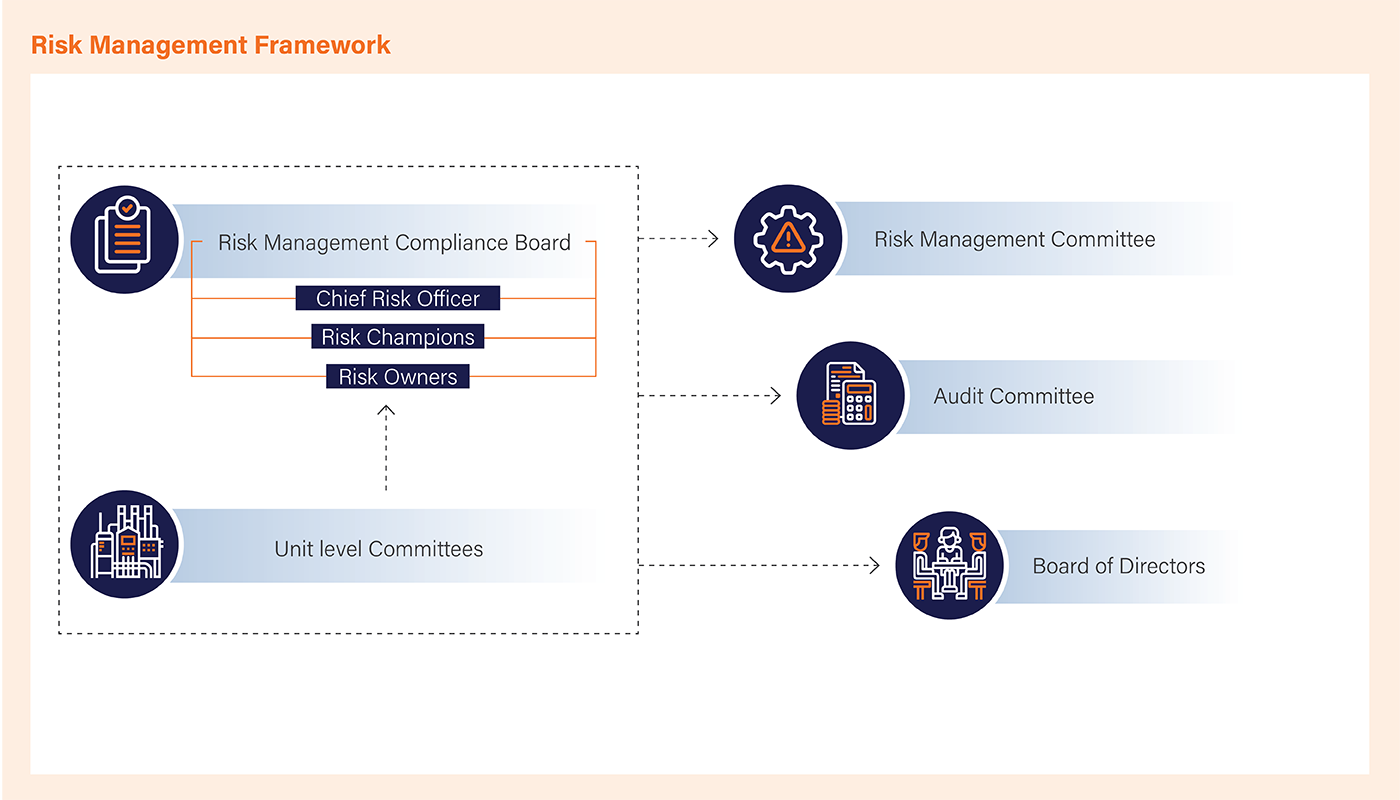

- Navigating Risks,

Forging Excellence - Business Model Fuelling

Prosperity - Materiality Assessment

- Collective Vision, Shared Responsibility

- Empowering Trust through Governance

- Board of Directors

- Making a Difference,

SDGs in Motion Description of Capitals

- Financial Capital

- Manufactured Capital

- Intellectual Capital

- Human Capital

- Social and Relationship Capital

- Natural Capital

- Awards and Accolades

Corporate Information

- Core Team

- Senior Management Team

- Main Offices and Major Units

- Group Companies

- Performance at a Glance

Financial Statements

Standalone Financial Statements

- Independent Auditors’ Report

- Balance Sheet

- Statement of Profit & Loss

- Cash Flows Statement

- Statement of Changes in Equity

- Notes

- Income & Expenditure Account-Township, etc.

Consolidated Financial Statements

- Independent Auditors’ Report

- Balance Sheet

- Statement of Profit & Loss

- Cash Flows Statement

- Statement of Changes in Equity

- Notes

- Harnessing Infinite Energy,