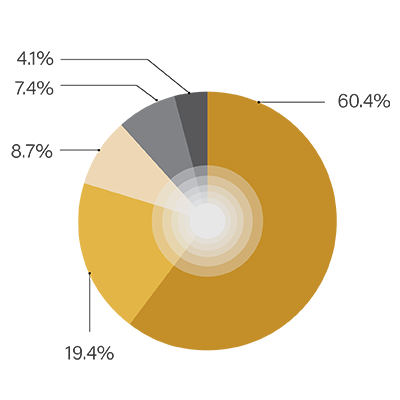

Maintained our industry leadership position with a market share of 44.6% and sales volume of 85.8 MMT (excl. LNG).

Commissioned 1,784 retail outlets (including Kesan Seva Kendra), 303 CNG stations. Also commissioned 3,321 EV charging stations and 44 battery swapping stations.

Commissioned 10 LPG bottling plants, 5 in greenfield and 5 through private bottlers.

IndianOil Aviation also retained its market leadership in 2022-23, holding a market share of 61.3% and sales volume of 4,514 TMT.

Commissioned 5 new AFSs at Deoghar, Hollongi, INS Parundu (Ramnad), Cooch Behar, and Belgavi, expanding the total count to 132 AFSs across India. The construction of a state-of-the-art Hydrant Refueling System at Kalaikunda AFS for Indian Air Force aircrafts was successfully completed, with operations expected to commence soon.

To meet fleet expansion demands, IndianOil Aviation procured 60 new Refuelers from BG Cryogenics, utilising their in-house facility.

Achieved highest-ever production of 40,051 Cryocans and 90 Industrial Containers.

Moreover 115 Filter Casings on existing Refuellers were upgraded to Filter Water Separator casings, in compliance with latest regulatory guidelines.

POL product commissioning and commercial loading have commenced with automation at Silchar Depot, Guntakal Depot, Motihari Terminal, and Asanur Terminal, providing a total tankage capacity of 238 TKLs. Additionally, brownfield expansion projects at Manmad, Ahmednagar, Ahmedabad, Ratlam, and Vijaywada Terminal have been commissioned, adding a total tankage capacity of 411 TKLs. Vizag’s additional tankage capacity of 43 TKLs is ready for commissioning and is awaiting OISD clearance.

We commissioned three high-pressure Homogenizers at the Vashi Grease Plant last December for SERVO which resulted in a notable 20% increase in production.

During 2022-23, 41 OEM approvals were received from major automotive companies such as Tata Motors, Ashok Leyland, MG Motors, Hero Motors, TVS Motors, Mahindra & Mahindra, Blue Energy, Cummins, and so on.

Flag off Ceremony for Branded LPG Delivery Vehicles in Gujarat, showcasing unity and brand promotion - a first in the country